“Ever tried setting a savings goal and found yourself binge-buying avocado toast instead? Yeah, us too.”

Saving money as a young person can feel like trying to fill a leaky bucket—frustrating, messy, and often pointless. But here’s the good news: mastering monthly savings targets doesn’t have to be a soul-sucking chore. By leveraging youth savings accounts and adopting smart strategies, you can build habits that set you up for lifelong financial success.

In this guide, we’ll explore why monthly savings targets are crucial for young savers, walk you through actionable steps to implement them, and sprinkle in some brutal honesty about what NOT to do. Plus, there’s a Tamagotchi reference at the end because why not?

Table of Contents

- Why Monthly Savings Targets Matter for Young Savers

- Step-by-Step Guide to Setting Realistic Targets

- Tips & Best Practices for Sticking to Your Goals

- Real-Life Success Stories from Smart Savers

- Frequently Asked Questions About Monthly Savings Targets

Key Takeaways

- Youth savings accounts are powerful tools to kickstart financial independence.

- Monthly savings targets help you break big goals into bite-sized chunks.

- Automation is your best friend when it comes to sticking to your plan.

- Avoid falling for get-rich-quick schemes—they’re terrible advice!

Why Monthly Savings Targets Matter for Young Savers

Figure 1: The struggle of saving without clear targets.

Let me tell you a quick story about my epic fail: I once decided to save $5,000 over six months. Sounds ambitious, right? Well, guess how much I saved by month three… zero dollars. Why? Because I never broke down that massive number into realistic monthly savings targets. Instead, every paycheck disappeared faster than free pizza at a college party.

The truth is, most youth savings accounts come with low fees and decent interest rates, but they won’t work magic on their own. That’s where monthly savings targets shine. They give you clarity, motivation, and accountability—the trifecta of successful saving.

Data backs this up too. According to a recent survey, people who set specific savings goals are 3x more likely to stick to their plans than those who don’t. So yeah, having a concrete target matters.

Step-by-Step Guide to Setting Realistic Targets

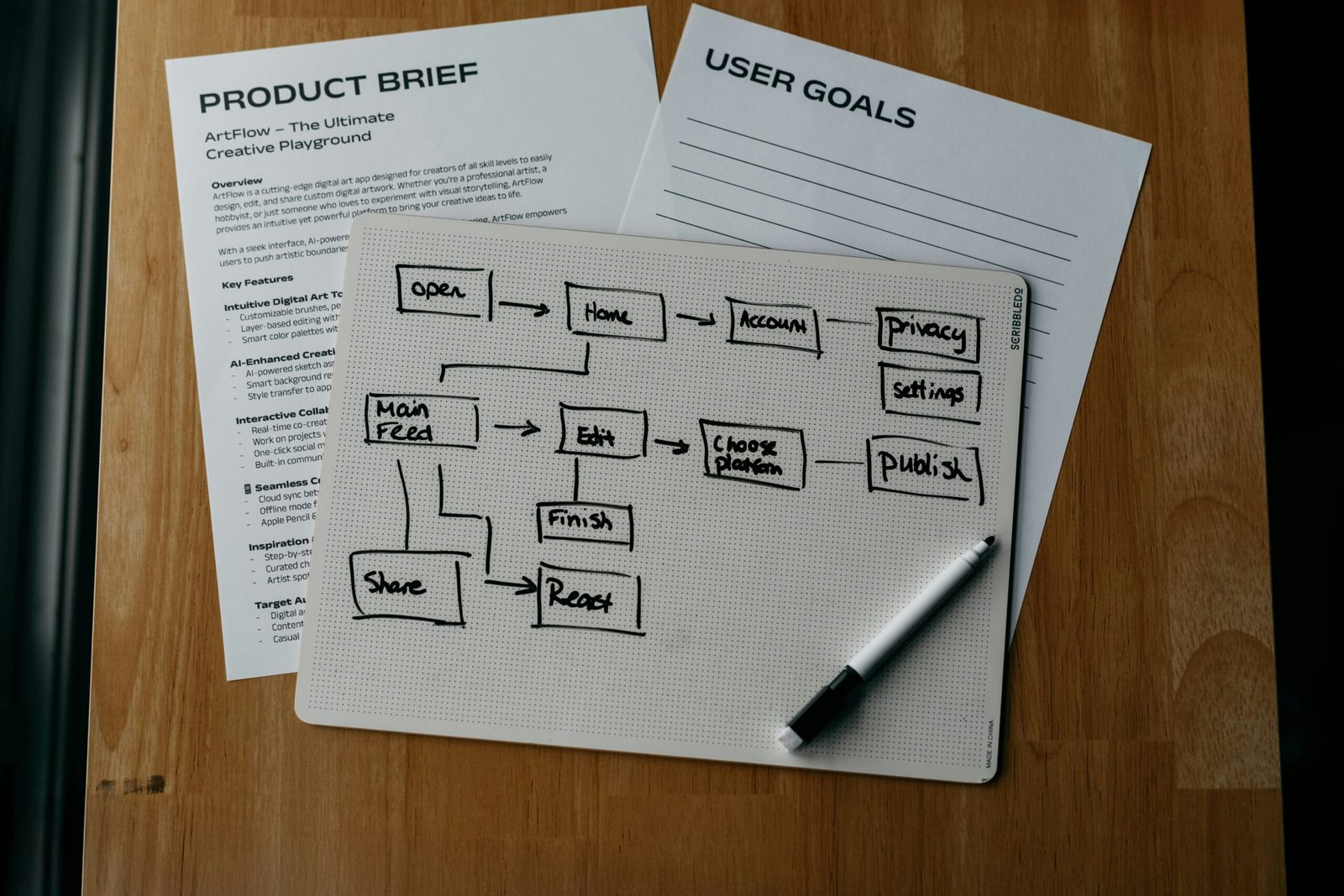

Figure 2: A step-by-step infographic for setting monthly savings targets.

Alright, enough chit-chat. Let’s dive into the nitty-gritty.

Step 1: Define What You’re Saving For

Optimist You: “I want to buy a car!”

Grumpy You: “Cool, but how much does it cost?”

Clarity is queen. Write down exactly why you’re saving—it could be a dream vacation, an emergency fund, or even retirement (yes, start now). Be specific about the amount so you know what you’re aiming for.

Step 2: Break It Down Into Monthly Targets

If your goal is $6,000 and you have a year to reach it, divide it by 12. Boom, $500 per month. Easy peasy, lemon squeezy.

Step 3: Automate Contributions

Pro tip: Set up automatic transfers to your youth savings account. This way, you’re paying yourself first—no excuses allowed.

Step 4: Track Progress Weekly

Use budgeting apps like Mint or YNAB to monitor your progress. Think of it like leveling up in a video game—you get dopamine hits each time you hit milestones.

Step 5: Adjust as Needed

Sometimes life happens, and your targets need tweaking. Maybe rent went up, or you got a raise. Either way, flexibility is key.

Tips & Best Practices for Sticking to Your Goals

Figure 3: Visual comparison of common spending vs saving behaviors.

- Pay Off Debt First: High-interest debt eats away at potential savings. Tackle any credit card balances before ramping up contributions.

- Redirect Windfalls: Got a tax refund or birthday cash? Shove it straight into savings.

- Ignore FOMO: That concert ticket might seem worth it today, but future-you will thank present-you for skipping it.

- Terrific Tip Disclaimer: DO NOT invest in sketchy side hustles promising overnight riches. Pyramid schemes aren’t investments—they’re scams.

Real-Life Success Stories from Smart Savers

Meet Sarah, a college student who started small with $50/month contributions to her youth savings account. Within two years, she had enough stashed away for a down payment on a used car—all thanks to consistent monthly savings targets.

Then there’s Jake, who turned his hobby of flipping sneakers into a thriving business. He credits his ability to reinvest profits back into inventory (instead of impulse buys) to disciplined savings habits.

See? It’s totally possible.

Frequently Asked Questions About Monthly Savings Targets

Q: How Much Should I Save Each Month?

A: Aim for at least 20% of your income if possible. Start smaller if needed, then increase gradually.

Q: Can Youth Savings Accounts Really Make a Difference?

A: Absolutely. Their low fees and compound interest add up faster than you’d think.

Q: Is Automation Worth It?

A: Yes. Out of sight, out of mind = fewer temptations.

Conclusion

Setting and sticking to monthly savings targets isn’t just smart; it’s empowering. Whether you’re dreaming of owning a home, traveling the world, or simply building an emergency fund, these strategies will keep you on track.

Now go forth and conquer that avocado toast habit!

Like a Tamagotchi, your savings require daily love and care.

Feed it wisely, and watch it grow into something beautiful.