“Ever stared at your bank balance and thought, ‘Where does all my money go?’ Yeah, we’ve been there too.”

For young people navigating the unpredictable financial landscape, youth savings accounts are both a blessing and, if mismanaged, a source of stress. The real trick to making it work? Goal-based saving strategies.

In this post, you’ll discover:

- The truth about why traditional saving advice doesn’t stick for today’s youth.

- Actionable steps to set up a personalized goal-based system (even on a teen budget).

- Tips to maximize returns while keeping risks low.

- A rant about sneaky banking fees and why they’re the actual worst.

Table of Contents

- The Problem with “Just Save” Advice

- Step-by-Step Guide to Setting Up Goal-Based Savings

- 5 Best Practices for Youth Savers

- Real-Life Examples of Successful Young Savers

- Frequently Asked Questions

Key Takeaways

- Youth savings accounts provide a foundation but require intentional planning.

- Goal-based saving turns vague aspirations into concrete milestones.

- Early financial habits can shape future wealth-building strategies.

The Problem with “Just Save” Advice

Saving sounds simple enough in theory—just set aside some cash every month, right? Wrong.

I once tried the classic “save whatever’s left over” method. Spoiler alert: I had $0 leftover by paycheck day. Sound familiar?

Why traditional saving fails:

- No clear purpose makes motivation fizzle fast.

- Life expenses eat up all available funds before savings happen.

- Without measurable progress, it’s easy to lose focus.

This is where goal-based saving swoops in like Spiderman catching you mid-fall. It flips the script from aimless stashing to strategic planning.

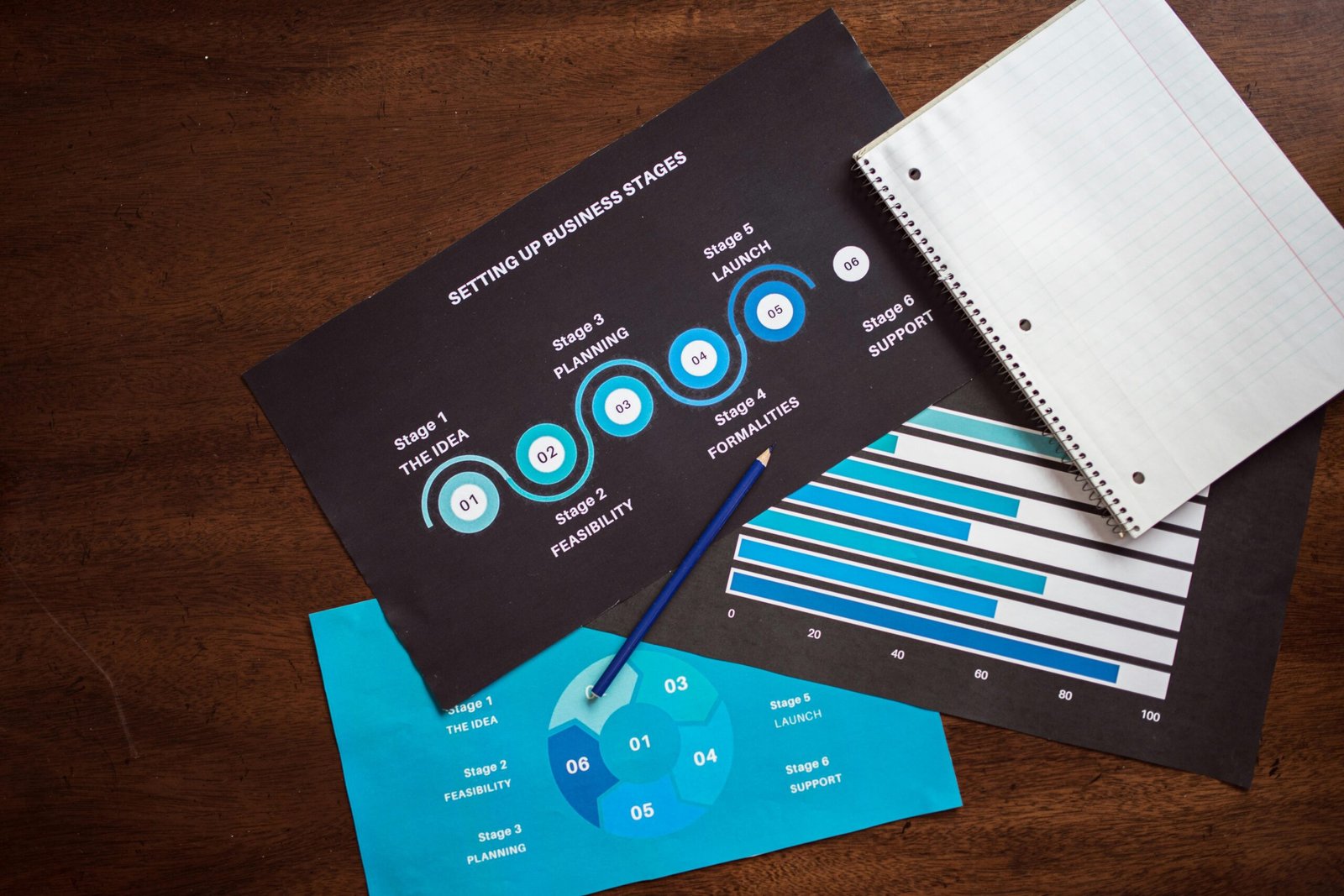

Step-by-Step Guide to Setting Up Goal-Based Savings

Step 1: Define Your Goals

Optimist You: “Let’s save for everything!”

Grumpy You: “Slow down, sparky. Be realistic.”

Start small. For example:

- Short-Term: New sneakers ($150).

- Medium-Term: Emergency fund ($500).

- Long-Term: College tuition ($5,000).

Step 2: Choose the Right Tools

Open a youth savings account specifically designed for younger users. Look for features like low fees, high interest rates, and parental controls if needed.

A trusted option is the Chase Youth Account, which offers zero monthly fees and digital banking tools.

Step 3: Automate Contributions

Set up automatic transfers to avoid forgetting or spending your intended savings. Most banks have apps that let you schedule recurring deposits.

5 Best Practices for Youth Savers

- Track Expenses: Use budgeting apps like Mint to see where your money goes.

- Prioritize Needs Over Wants: A latte habit adds up—swap one coffee shop trip weekly for homemade brews.

- Earn Extra Income: Freelance gigs or summer jobs can boost your savings game.

- Ignore Temptation: Swipe left on impulse buys; swipe right on savings goals.

- Avoid High Fees: Skip unnecessary charges like ATM withdrawal fees or overdraft penalties.

Real-Life Examples of Successful Young Savers

Case Study 1: Sarah, age 16, saved $2,000 for her first car using a combination of babysitting income and automated transfers. She prioritized short-term sacrifices (no movie nights) for long-term gains (freedom via wheels).

Case Study 2: Jake, age 18, avoided student debt by stashing away holiday earnings into his youth savings account. With consistent deposits, he earned enough interest alone to cover part of his textbook costs.

Frequently Asked Questions

What’s the minimum amount to start a youth savings account?

Most institutions require only $1-$50 to open an account. Check local banks or credit unions for specific details.

How safe is my money?

Federally insured accounts protect your funds up to $250,000 per depositor. Always confirm FDIC or NCUA insurance status when choosing a provider.

Conclusion

Goal-based saving transforms vague money dreams into achievable realities. Whether it’s buying cool gadgets or building emergency safety nets, youth savings accounts give you the tools to thrive financially without breaking a sweat.

And remember: Like feeding Tamagotchis in the ’90s, nurturing your savings demands consistent care—but the payoff is oh-so worth it.